If you're an American who enjoys travel to the UK, you've probably been wondering about some of the latest headlines:

- “British Pound Plummets to Record Low Against the Dollar”

- “Pound Hits Record Low After Tax Cut Plans”

- “Strong Dollar is Good for the US but Bad for the World”

- “Pound Resumes Slide after BoE and Treasury Seek to Steady Markets”

At the time I'm typing this, the cost of 1 GBP is $1.07 (USD). In recent years, it's been as high as $2.06 for a single pound (back in 2007). During the last 5 years – until the slide of the last couple months – it's mostly been within the $1.20-$1.40 range. Prior to that, it was usually in the $1.50-$2.00 range.

If you've been wondering how to capitalise on that opportunity, keep reading. There are a couple great ways to make the most of it.

Table of Contents

What Does the GBP – USD Exchange Rate Mean for Your Purchasing Power?

Let's say you anticipate spending roughly 1000 GBP over the course of your next trip. Most of us book our flights and hotels using sites in our native currency, so we'll just pretend we're talking about a fairly middle-of-the-road expenditure for things like meals and incidentals.

Today, with a cost of $1.07 USD per GBP, you'd spend $1070 (plus transaction fees) to get your 1000 GBP.

Now, suppose some time has passed and the exchange rate has turned around a bit, bringing the cost of 1 GBP up to $1.33 USD (a fairly typical number over the last 5 years).

With a cost of $1.33 USD per GBP, you'll spend $1330 (plus transaction fees) to get the same 1000 GBP.

The difference in exchange rate accounts for a $260 difference in the cost to you.

If you're in the habit of booking your lodging directly (in pounds) and buying all your tour tickets and parking passes and whatnot ahead of time, the exchange rate difference becomes even more important. If you expect to spend 4000-5000 GBP, the difference in the same exchange rate scenario becomes $1040-1300 in savings.

How Can You Take Advantage of the Historically Low GBP to USD Exchange Rate?

First off – please note that nothing we say here should be construed as investment advice. The exchange rate IS historically low, but any time you buy and hold funds in another currency, there is risk. There's also a risk to holding all your money in your own currency, should it lose value in comparison to other currencies. Life is risk, right?

Obviously, buying pounds sterling is NOT like buying the currency of an unstable developing country – but even so, there's always a chance the exchange rates could stay as they are for a long time. We could even see the pound get cheaper against the dollar.

A lot of people have been asking whether you can pre-purchase the pounds you'll carry on an upcoming trip, and yes – you can definitely do that. Just make sure you get the new polymer bills rather than the old paper ones. It shouldn't be an issue with most reputable banks and services, but we did want to mention that the UK's paper notes will no lose legal tender status soon. Read more on that HERE if you need further details.

Getting pounds in cash is definitely one way to take advantage of the great exchange rate, but there are other ways to enjoy the historically huge purchasing power you have right now.

Hold British Pounds in an Online Bank Account

While it's not too difficult to order British pounds at your local bank, it has some downsides:

- You have to store and protect it from fire, theft, loss, etc.

- When you finally DO go to the UK, you might be carrying more cash than you're comfortable with.

- If something happens and you can't go on the trip and you need the money ASAP, you're going to have to figure out where you left the money and go back to the bank (easy enough if you're at home, harder if you're away when catastrophe strikes).

For many, it's more practical to open an account with Wise (formerly TransferWise). They're a British company that allows Americans (and those from many other countries) to open accounts and hold funds in other currencies.

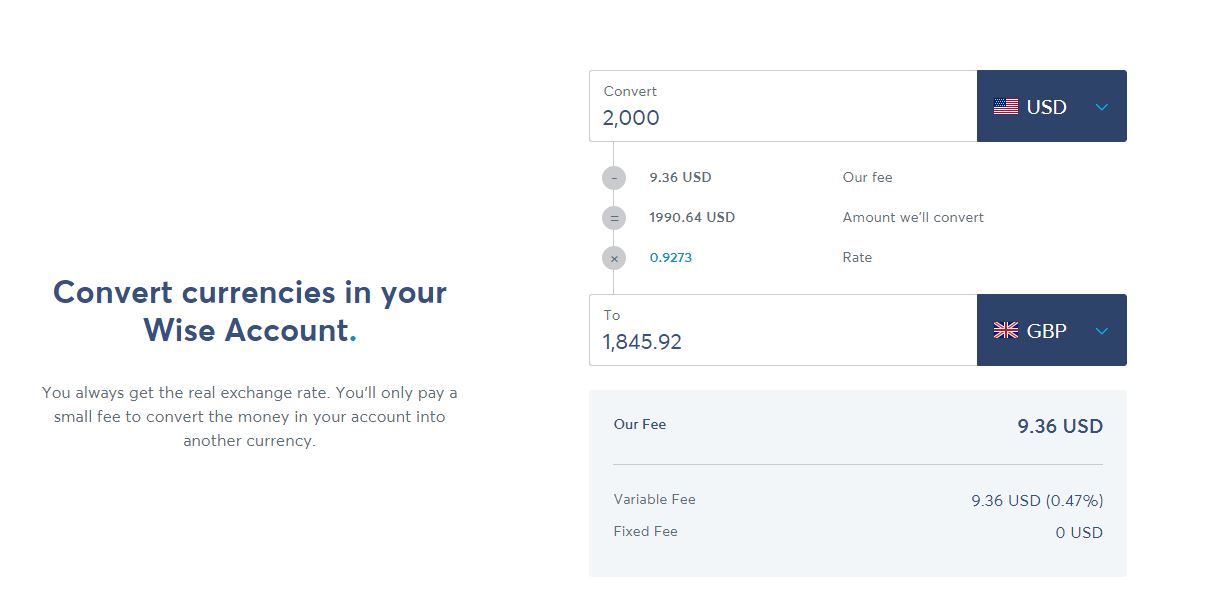

Fees for conversion are minimal (see the below example, based on exchange rates as of September 26th, 2022), and if you're in the US, they can give you a debit card that allows you to access the funds and buy things when you're in the UK or even online – without paying those “foreign transaction fees” many credit cards add on every purchase made abroad.

The nice part about having an account with the ability to hold your money in GBP is that you can convert money when the exchange rate is good, then hold it until you actually need to spend it – making it ideal for saving up for a wedding, semester abroad, or expensive trip. If you find yourself suddenly needing the money for an emergency at home, you can always convert it back to USD and transfer it out without hassle.

How does it work? Once you set up your account and verify your identity, you can select the option to open an account within your account so you can store pounds. Since they give you full bank details and a debit card, it's also incredibly convenient if you do business overseas or need to accept money in a non-USD currency.

Want to set up a Wise account so you can store British pounds? Click here to use our referral link and your first transfer (up to $600) will be free. In the interest of full disclosure, we also get a small payment from them for every three people who use the link and meet a certain minimum funding amount. We use Wise here and our experience has been entirely positive.

Go Shopping…in Pounds

Don't get me wrong – I'm not suggesting you run out and buy a bunch of things simply because the exchange rate is good. However, if there are any large purchases you've been contemplating (especially from a British brand), this is a great time to revisit that idea and see how much more affordable it's become under the current exchange rates.

Similarly, if there are small, expensive, and relatively easy-to-ship items you've been thinking of buying, you might consider checking British retailers to see how it stacks up once you factor in shipping and the exchange rate. I saved nearly $200 on a Barbour jacket, but the savings can be even bigger on things like jewellery, small antiques, more expensive luxury brands, and rare books.

Even if a retailer isn't willing or able to ship to the US, there are easy online services that will forward your purchases to the US. For more details, check out: “How to Get British Products Forwarded to the US”.

Just remember that some things (like perfume, which is flammable) are banned by most forwarding services. A bottle of Creed perfume may run $425 here vs. £260 in the UK, but in most cases, the hazardous goods surcharges are likely to eat up any savings.

How Often Do Exchange Rates Change?

If you're hoping to take advantage of the current drop in the value of the pound, you may be wondering how long you have to take action. Unfortunately, that's not something we can answer. These things are determined by a million different economic and political and policy factors all working in relation to one another, but the one thing you can always count on is this: They're always changing.

In the time it took us to write this post, the exchange rate changed form $1.07 per GBP to $1.08. By tomorrow, it will likely change again – and the direction is anyone's guess. If you look at the screenshot of the historic chart below (get the live Google version of this by clicking HERE), you can see the rates are never in one place for too long, and they vary quite a lot.

Some experts believe the dollar and pound could be equal in value by some point this year – but there's no guarantee that will happen, of course.

Again, please don't take any of this as advice on what's appropriate for YOU to do. We're all different, with different needs, motivations, risk tolerance, and bank balances. Furthermore, past performance is no indicator of future performance. The GBP may never again reach a value of $2…but then again, it could.

Our only goal with this post is to give you some ideas on how someone with USD might benefit from the current exchange rate and/or lock it in to fund a future purchase or trip. We hope you've found it useful!